A Technopreneur Lens

895 words | 3.2 minute read

In Musing 1 we explored the foundation of Eroom’s Law. In Musing 2 we pirouetted our way through author reflections a decade after publication, dusted with contrasting views on trends in the cost of Drug Discovery R&D (R&D). We conclude in Musing 3 with the last of our three step with look from a Technopreneural lens.

First, a preemptive caveat, acknowledging that R&D is an immensely intricate undertaking complicated by imposing financial considerations and multifaceted regulatory constraints. With due deference to these challenges and conventional thinking, I propose three corollaries to Eroom’s Law on why Drug Discovery R&D costs continue to rise:

- GAAP accounting inciting less than optimal decision making.

- Lobbying and regulation creating artificial barriers to a competitive market.

- A consensus me-too mentality akin to technology in the 1970’s.

Corollaries 1 and 2 are beasts to be slayed another day. Corollary 3 is today’s focus. First, let us summarize why we believe costs are rising despite positive trends in the number of new drugs approved by the FDA. Then we use COVID-19 induced acute respiratory distress syndrome (ARDS) as mini-case study in herd mentality of corollary 3. Regrettably, the metaphor of “throwing it against the wall to see what sticks is encouraged by corollary 1.

Reverberation #1: Increasing R&D Cost Beacons

- Industry wide pre-clinical development averages $474 million per drug approval. Source

- The CBO increases this estimate to 43 percent when “capital costs” are included. Source

- Only 12% of drugs enter phase I trials gain approval. Source

- $690 million is added to the cost of each approved drug for failures. Source

Unintended Consequences

Public companies have built-in incentives to control negative information and earnings estimates. Walking away from a R&D initiative brings losses into the current period. Keeping R&D in play relegates sunk cost to the balance sheet instead of impacting the income statement. Science and business careers, professional reputations and advancement are tied to keeping a losing endeavor on life support.

An entrepreneurial company is still driven by investor expectations, however, there is always a drive to capital preservation. Those looking for career advancement generally remain in corporate entities.

ARDS Case Mini-Study

The World Health Organization identified ARDS as the leading cause of death among COVID-19 infected patients. While the typical mortality rate amongst ARDS patients is 30% to 50%, COVID induced ARDS patients experience mortality in the 50% to 75% range. Source

As the pandemic intensified, avalanches of opportunity materialized. Many set out to repurpose drugs in their pipeline in the name of ARDS treatment. My entrepreneurial instincts point to inefficiency not in the “try”, but in the push into the FDA process absent a good science bedrock. Many companies repurposed drugs that work in a similar manner that simply blocks on one of many elements of ARDS induced inflammation.

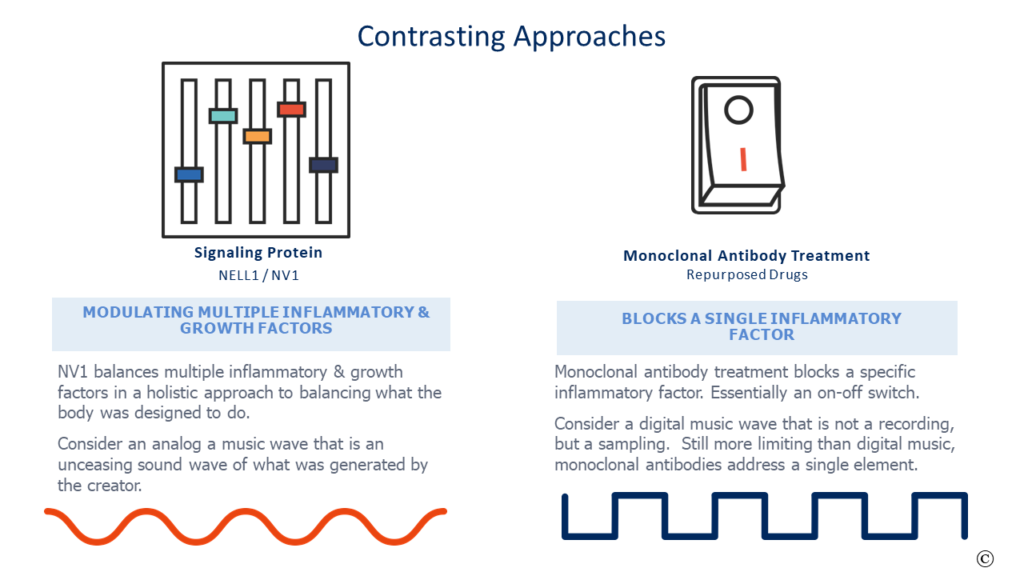

Most of the repurposed drugs are monoclonal antibody (mAB) therapies that bind to an interleukin to shut it off. There are numerous interleukins in our body, and they are one of several factors creating inflammation. Turning off an interleukin has value in selected situations, however, with ARDS these treatments appear to offer too limited a focus with no regenerative merits. Think of a tub of bath water- if it is too cold do you turn off the cold water for days or balance the hot and cold to the desired mix?

Most people choose to balance the water temperature. Now expand the metaphor with multiple variables in maladies such as ARDS and one can begin to understand the uphill battle to treat a complicated condition such as ARDS by addressing a single aspect like an on-off switch.

This theoretical hurdle is validated when one considers (as of May 2021) the failed or delayed clinical trials submitted by well capitalized entities involving mAB candidates. This overview does not take into consideration repurposed stem cell or small molecule candidates with their own novel treatment challenges.

However, all is lost, as the same lot of repurposed mAB candidates has shown narrow potential as depicted below. It is notable none of offerings seem to treat ARDS for many or address recovery.

The cost of all of these failed “repurposing” rolls into the estimated $474 million in sunk costs facet of R&D. A common justification for these types of failures is that drugs act differently in human trials than on a lab bench. Considering the breadth of the listed failed attempts, that rationalizing elicits hesitation.

A Different Approach

In full disclosure, my daytime gig is at NellOne, a company whose name is eponymous to the naturally occurring secreted human protein NELL1, that we commercialize. NELL1 and our proprietary variant NV1 balance rather than block numerous inflammatory factors while recruiting mesenchymal stem cells to promote regeneration. It is a holistic approach to treatment that has early promising results .

More germane to this commentary is that NV1 attacks ARDS in a different and more complete means than the repurposed alternatives. It is a potential treatment that would be a disruptive and consequential improvement over current alternatives instead of an incremental half-step. A new approach that is riskier to validate from a career and accounting lens, but one that would address the “Better than the Beatles” aspect of Eroom’s law.

In the 1970’s they use to say, “no one ever got fired for hiring IBM”. Technopreneurs changed that paradigm a little bit at a time and then all at once. Could that be the future of Drug Discovery R&D?

Postscript update on Lenzilumab News